Going into 2023, there was a lot of talk about a possible recession that would cause the housing market to crash. Some in the media were even forecasting home prices would drop by as much as 10-20%—and that might have made you feel a bit unsure about buying a home.

But here’s what actually happened: home prices went up more than usual. Brian D. Luke, Head of Commodities at S&P Dow Jones Indices, explains:

“Looking back at the year, 2023 appears to have exceeded average annual home price gains over the past 35 years.”

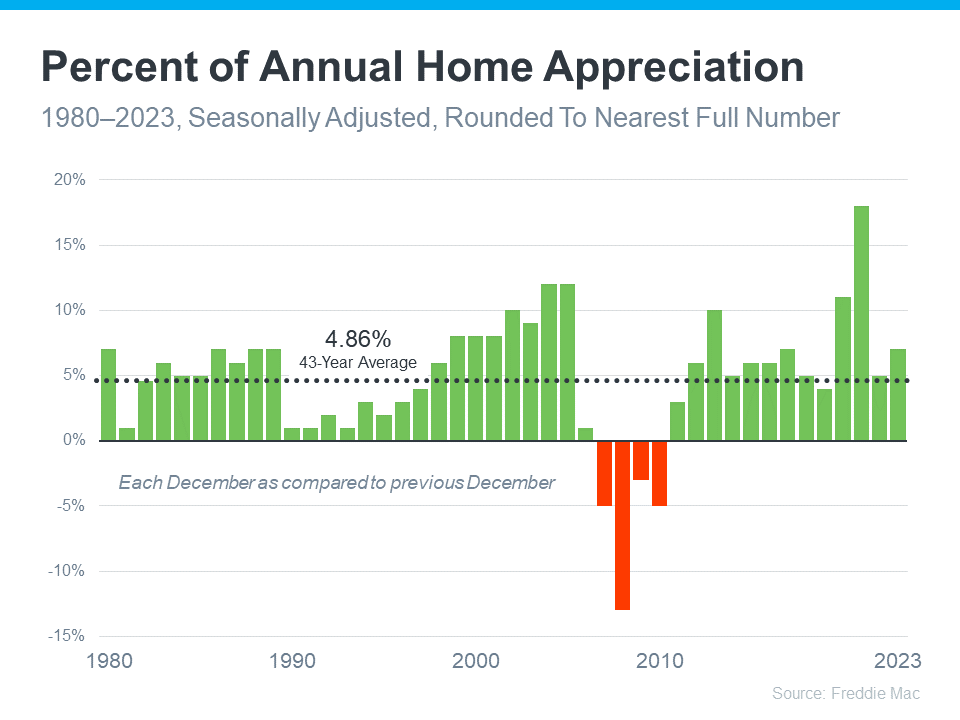

To put last year’s growth into context, the graph below uses data from Freddie Mac on how home prices have changed each year going back to 1980. The dotted line shows the long-term average for appreciation:

The big takeaway? Home prices almost always go up.

As an article from Forbes says:

“. . . the U.S. real estate market has a long and reliable history of increasing in value over time.”

In fact, since 1980, the only time home prices dropped was during the housing market crash (shown in red in the graph above). Fortunately, the market today isn’t like it was in 2008. For starters, there aren’t enough available homes to meet buyer demand right now. On top of that, homeowners have a tremendous amount of equity, so they’re on much stronger footing than they were back then. That means there won’t be a wave of foreclosures that causes prices to fall.

The fact that home values went up every single year except those four in red is why owning a home can be one of the smartest moves you can make. When you’re a homeowner, you own something that typically becomes more valuable over time. And as your home’s value appreciates, your net worth grows.

So, if you’re financially stable and prepared for the costs and expenses of homeownership, buying a home might make a lot of sense for you.

Bottom Line

Home prices almost always go up over time. That makes buying a home a smart move, if you’re ready and able. Let’s connect to talk about your goals and what’s available in our area. What Mortgage Rate Do You Need To Move?Why Today’s Seller’s Market Is Good for Your Bottom Line

Alexander PlotkinLicensed Real Estate Associate BrokerExp Realty9175448520I’m a Brooklyn,NY residents since 1989 and have been working as a full time professional Realtor since 1995. I love the borough, its people and the diversity of its neighborhoods. Every customer and client is unique and my marketing strategy reflects their goals. share a fervent belief that to be a successful real estate professional requires honesty, integrity and loyalty. Above all, the ability to listen is the most important quality an agent must possess and my client needs always come first

Visit WebsiteGet In Touch

Standardized Operating Procedure available on any publicly available website and mobile device application maintained by the Broker and any of its licensees and teams. Broker has copies of these Standardized Operating Procedures available to the public upon request at Broker’s office location. Please be advised that Broker: 1. Does not require Prospective buyer clients to show identification* 2. Does not require Exclusive Buyer Broker Agreements 3. Does not require pre-approval for a mortgage loan / proof of funds.* *Although Broker may not require such information, a seller of real estate may require this information prior to showing the property and/or as part of any purchase offer.

FREE EGUIDE

Things to Consider When Buying a Home

https://www.google.com/recaptcha/api2/anchor?ar=1&k=6LdvlygjAAAAAO9oKE2_lBo4Sd_9PZfp5XuG7yCQ&co=aHR0cHM6Ly93d3cuc2ltcGxpZnlpbmd0aGVtYXJrZXQuY29tOjQ0Mw..&hl=en&v=Hq4JZivTyQ7GP8Kt571Tzodj&size=normal&cb=4mfsjrv3jlb7Send Me This eGuide

CATEGORIES

Select Category Baby Boomers For Buyers Buying Myths Demographics Distressed Properties Do Not Autopost Down Payments Featured First Time Home Buyers Foreclosures FSBOs Generation X Holidays Housing Market Updates Infographics Interest Rates Internal Luxury Market Market Education Member Webinar Member Exclusive Webinar Millennials Move-Up Buyers New Construction Outdated Pricing Rent vs. Buy For Sellers Selling Myths Senior Market Time-sensitive

The information contained, and the opinions expressed, in this article are not intended to be construed as investment advice. Alexander Plotkin and Keeping Current Matters, Inc. do not guarantee or warrant the accuracy or completeness of the information or opinions contained herein. Nothing herein should be construed as investment advice. You should always conduct your own research and due diligence and obtain professional advice before making any investment decision. Alexander Plotkin and Keeping Current Matters, Inc. will not be liable for any loss or damage caused by your reliance on the information or opinions contained herein.